Topic Sheets

20% of Retirees Will Run Out Of Money

Research shows about 20% of retirees are spending their super at 'unsustainable' levels. What does that mean? It means about one fifth of us will most likely outlive our retirement savings. And...

Read More

80 Million in Unclaimed...

Could your family locate your important documents?

There is $80 million in unclaimed life insurance in Australia. Why? It certainly raises the question whether a lot of loved ones even KNEW a policy existed. Our article shares the story of how one entrepreneur created a business to help those in need at that most incredibly stressful time following a death in the family.

Read More

A home of one's own

Are you flying solo and starting to think that buying a property will never be possible? there's really no need to wait for a knight, or lady in shining armor to come along, as securing finance on a single income does happen.

Read More

Beauty at a cost - renovating a heritage listed home

Seeped in cultural and historical significance, it's understandable that there are restrictions when renovating a heritage listed home. While that's not to say that you can't make any changes, a little more legwork and creativity is often required.

Read More

Buying a property with friends

If you’re looking for a creative way to overcome being locked out of the property market by rising prices, buying a house with a group of friends may be a solution. It can also be a minefield though, so here’s how to avoid a blast.

Read More

Buying a Tenanted Investment Property

There are plenty of upsides to buying an investment property that already has a tenant, as well as a raft of risks. Here's how to minimise them...

Read More

Can you manage a Mortgage and a Baby?

Can we manage a mortgage and a baby?

It’s amazing how a new baby can turn your household upside down - but we all learn to be flexible. At this time we may also need to adjust to a reduced household income with the added expense of a new baby. So how do we build flexibility into our finances? Planning is the key!

Read More

Change is coming 1 July - SUPER!

Okay, so maybe you’re thinking that retirement for you is a long way off? Should you be worried?

Read More

Crushing Credit Card Debt

Crushing credit card debt. Choosing the option that works for YOU!

The reality of festive season extravagance often kicks in about this time of year – all in black and white on our credit card statement! There are several options for paying down credit card debt – we explore what you should know. Of course the best option is the one that works for YOU!

Read More

Family to help or not to help?

Do you have children trying to get into the property market? Are your children wondering if it will ever be possible to buy a property in today’s market?

Previous Reserve Bank governor Glenn Stevens stated that the only way for young people to get onto the property ladder in Australia’s most heated market - Sydney - is with the help of their parents.

Read More

Finding the right loan

How do you match a loan and lender to your needs? Rather than running around finding out the details of each and every lender and loan, draw on the expertise of a Finance Broker.

Read More

First Home Buyers

Do you have children trying to get into the property market? Are your children wondering if it will ever be possible to buy a property in today’s market?

Read More

Five simple ways to increase loan repayments

Paying off a mortgage can seem relentless – every payment counts of course, but it can seem to be taking forever to make a dent. Here are some simple ways you can increase the amount you pay off and own your home sooner.

Read More

Getting ahead financially through debt consolidation

Generally your home provides the best opportunity to secure the most cost effective debt available in any given market. As your home is used as security against the loan, it provides the lender with additional confidence to lend money to you and at a lower interest rate than a credit card or personal loan. Read on...

Read More

How to avoid paying too much for a home

Knowing what a property is worth is central to avoiding paying too much for it.

Read More

How to buy without a 20% deposit

When you consider that a small flat in Sydney could set you back half a million dollars at the moment, saving a 20% deposit to buy that flat – $100,000 – can seem an insurmountable task. That’s where insurance can help.

Read More

How to pay off your home loan faster and save some big bucks!!!

Reducing the life of your loan isn’t difficult; there are many simple things you can do to cut years off your mortgage. Here are some tips that will help you be mortgage-free sooner than planned.

Read More

How to refinance to renovate

Refinancing your assets to renovate a property is a significant decision that will hopefully improve your standard of living or add substantial value to your property.

Read More

How to save a much larger home deposit

When you are thinking about your first home, finding out you should be thinking about saving for a 20 per cent deposit can seem really overwhelming.

Read More

How to speed up your home loan approval

Asking how long it takes to get a loan approved is like asking how long a piece of string is. Every application is unique, so the time between your first contact with your bank or broker and approval can never be predetermined. There are, however, some things you can do to help hurry your application along.

Read More

Insurance for every age and every stage

Insurance is one of those ‘rainy day’ expenses. Many of us question whether we REALLY need it, but are glad we have it when we DO! You can insure for just about any eventuality these days so how do you know what you need? The reality is everyone’s personal situation and needs are different and will

change as ‘life’ changes. Below is a general overview of the policies you MIGHT NEED, WHEN you might need them and for HOW LONG you need them.

Are you covered?

Read More

Is switching loans a suitable alternative for me?

Your home loan is usually your largest financial commitment. We understand that changes in interest rates can have a big impact on your monthly repayments and how long it takes you to pay off your loan.

Read More

More than the big 4

The ‘Big 4’ banks have maintained a dominant profile in the complex and ever-changing Australian finance market - just think about how often you read about them in the news! And it is this high profile in our everyday lives that has contributed to a perception that all lenders are the same.

Read More

Protect yourself from future rate rises? Take our mortgage stress free test...

At the end of 2014 statistics showed a significant decrease in the percentage of homeowners experiencing mortgage stress - from 28% to around 15% - largely attributed to low interest rates. However, a further 15% of those surveyed were anticipating mortgage stress at some time in the future. Well it seems the future may be here...

Read More

Quarterly Question

We are often asked “Should I refinance my home loan regularly?” There are many reasons – and possible benefits – why you might consider refinancing but you should ALWAYS chat to us first. If you haven’t reviewed your home loan for a while then this is a must read!

Read More

Ready for the worst... Could you maintain your lifestyle in illness?

A recent study showed that 39% of Australians wouldn't have enough savings to maintain their lifestyle if they lost their income for 3 to 6 months.

In fact, an alarming 17% would find it difficult to get hold of $500 to $1,000 in an emergency.

For millions of Australians, maintaining a lifestyle simply means paying the mortgage and keeping on top of the bills - not everyone takes an overseas holiday every year!

Read More

Refinancing traps to avoid

Whether you're after lower repayments or want to tap into equity sitting in your home, refinancing can offer a world of benefits. Here are some things to be aware of so that you dont find yourself hooked into a bad deal.

Read More

Rentvesting - enter the property market without sacrificing your current lifestyle

As property prices continue to rise, purchasing in a centrally-located or sough-after area is out of reach for the average working millennial. Instead, many are opting to rent rather than buy as it means not having to compromise their inner city or beachside lifestyle. But for those who are still eager to enter the market, there is a way to get the best of both worlds.

Read More

Selling your home? Here are the first steps to take

There is more to selling your home than putting up a ‘For Sale’ sign on your front lawn. Here are the first things you should check off your list to help you get the largest return from your investment and to ensure the process runs as smoothly as possible.

Read More

Should we stay or should we go?

There is no end of financial advice on preparing for retirement: superannuation, investments, tax minimisation, age pension eligibility, funding your desired lifestyle - the list goes on. All this advice highlights the importance of planning ahead - sooner you start the better prepared you will be.

Read More

Steps to successful property investment

Property has been considered a popular path to wealth for Australians for many years. It has the potential to generate capital growth (an increase in the value of your asset) as well as rental income. There are also tax advantages associated with negative gearing. However, when buying an investment property, it is wise to remember that you are making a business decision and it’s worth taking the time to plan.

Read More

Taking control of your finances!

Statistics¹ show there are over 16 million credit cards in Australia with a national debt of $32.5 billion. Credit cards have become a common element of our day to day money habits. In addition, increasing your existing card’s credit limit is often as simple as ‘ticking a box’. As a result, many of us have access to a large amount of credit that is immediately available for any purpose, including those of us with an impulsive nature.

Read More

Teacher Mutual First Home Buyers

Teachers Mutual Bank Membership is open to citizens or permanent residents of Australia who are current or retired employees of the Australian education sector or family members of members of the Bank.

Read More

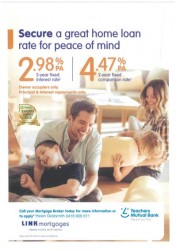

Teachers Mutual Bank Loan Offer

Teachers Mutual Bank Membership is open to citizens or permanent residents of Australia who are current or retired employees of the Australian education sector or family members of members of the Bank.

Read More

The Perfect Property at an Affordable Price - it's not a myth

So you’ve found your dream home, but it’s in need of a little TLC. While others may see this as a deterrent, this is actually a great opportunity to nab the house of your dreams at a price tag that’s within your means. Here’s how to tactfully negotiate the price without ruining your chances of securing the property.

Read More

Time to Refinance

A recent survey of Australian mortgage holders found 45% had NEVER refinanced their home. The report also found customers who DID refinance saved an average of $240 per month ($2,880 pa) by refinancing a 30 year loan. What would YOU do with an extra $240 each month?

Read More

Tiny Houses

It’s easy to understand why we look for the largest, most prestigious properties we can afford – we are constantly urged to define our success by our possessions: bigger, better, newer, faster, shinier. A relatively recent counter-movement, however, urges lower impact, fewer goods and less consumption, and at its core nestles the tiny house.

Read More

Top 15 ways to OWN your home sooner

Before taking action on any of the below ‘Top 15 Ways’, we recommend you speak with a finance specialist. Call the office for more information on any of these 15 suggestions.

Read More

Top ways to cut your expenses and increase your savings

Is the key to saving a home deposit as simple as giving up smashed avo toast for breakfast? Well not quite, but spending less does make a difference.

On top of a budget, a savings plan and strategies such as a high-interest savings account, an effective way to save is to reduce or eliminate expenses.

Read More

Underinsured? What's the worst that could happen?

Reports show Australia is highly underinsured compared to most developed countries – especially when it comes to insuring ourselves! So what does this mean for both us AND our families? We take a look at the possible impact on families and the reasons WHY so many of us don’t protect US! Worth a read.

Read More

Want to buy an Investment Property?

We were recently asked: “I want to purchase an investment property but I’m not sure where to start. What is required to make a good - AND safe -investment decision?”

Read More

What comes first: the property or the loan?

It’s easy to get carried away with the fun part of buying a property – looking at houses – but delaying the less compelling task of arranging finance will weaken your negotiating position on both the property and the loan.

Read More

What to consider before renovating

The decision to renovate is a common sticking point for homeowners, who can spend hours weighing up the cost benefits.

Read More

What to look for at an open house

There's an old saying that you should never judge a book by its cover, and this is true for houses - after all, who would buy some having never seen more than the front door? Open inspections are opportunities to really flick through the pages, and here's how to take full advantage.

Read More

When time is of the essence, call an expert!

Sometimes, getting a deal over the line in time requires a conversation with an industry expert!

Read More

Why your Broker asks so many questions??

Ever wondered why mortgage brokers have to ask you so many questions about your financial circumstances? It’s to ensure that fraudulent applications don’t slip through the cracks and that your loan suits your needs now and your plans for the future.

Read More

Will you have enough money in retirement

Our recent client survey revealed 48% of our survey respondents have an investment property! That's music to a finance specialists ears - it's satisfying to hear those people have a financial strategy that could lead to a more comfortable retirement. Read on...

Read More

Your interest rate may not be as it seems

At a time of almost constant (even daily) changes in the finance world - and an absolute overload of information online - it’s easy to see why some consumers are becoming ‘switched off’.

Read More